Despite the active development of alternative and renewable energy sources, traditional fuels definitely won’t soon give up their dominant market positions.

Moreover, more bets are being placed on the future of natural gas. According to the BP Energy Outlook, gas demand will grow in almost every country because of the availability of ‘blue fuel’ due to the expansion of the liquefied natural gas (LNG) market.

Long term future

The LNG market began to form about 50 years ago, and for a very long time, liquefied gas was perceived as an ‘exotic’ component of the fuel community. However, over time, more and more new players connected to it, and the demand grew every year. As is known, LNG is used to generate electricity in thermal power plants, especially during periods of high demand for heating and cooling, i.e., in the winter and summer months.

In recent years, the global LNG market has been developing quite actively. According to Russian sources, over the past six years alone, liquefied gas production has grown by 55 percent, from 244 million to 378 million tons per year. Based on current investment projects, it can be expected that by 2025 global capacity will increase by another 20 percent. Many experts are confident that LNG’s real demand is much higher than the exporting countries can cover. In the long term, the market will continue to grow at an average annual rate of 4 percent and will reach 527 million tons by 2030.

In 2017, the global LNG market, according to the GIIGNL, the International Group of Liquefied Natural Gas Importers, grew by 12 percent, in 2018 – by 8.3 percent, in 2019 – by 13 percent, reaching 355 million tons. Meanwhile, due to quarantine measures, global natural gas production in 2020 fell by 3.6 percent in 2020, to 3.918 trillion cubic meters. But even against this background, according to Rystad Energy, the global LNG production capacity in 2020 increased by 5 percent, reaching 464 million tons per year. One hundred million tons of spare capacity is an impressive figure. However, prices for this type of energy resource fell to the level of 2008, when the world was experiencing another economic crisis. Europe alone in 2020 reduced imports of liquefied natural gas by 7 percent from 2019, according to the data of the Gas Infrastructure Europe information platform.

However, the cold winter has helped LNG prices rise once more since the beginning of this year, and the ‘arms race’ in the LNG market has gained momentum again. As noted in the Fitch Ratings report, the increase in demand for LNG will lead to a reduction in oversupply in the market in the first half of 2021, as the volumes of gas in European storage facilities have already normalized due to the cold snap in the Northern Hemisphere. This led to higher prices in Europe and Asia, which improved the performance of resource producers. However, the LNG shortage is temporary – the excess capacity for liquefied natural gas will affect prices at the end of this year, when weather conditions improve and demand decreases, the rating agency expects.

Major players

Qatar is the leader in the LNG market – 26.5 percent. But its leading positions aren’t indisputable: the gap from the closest pursuer – Australia – is 0.5 percent (but everything there mainly focuses on the mainland’s self-sufficiency). The third and fourth places are held by the US (14.7 percent) and Russia (10 percent).

The LNG market has recently been shocked by the news that Qatar’s state oil and gas company, Qatar Petroleum (QP), has made the final investment decision to build the world’s largest LNG project, which will increase the country’s LNG production capacity by 43 percent. Production is expected to begin in the fourth quarter of 2025 and total around 1.4 million oil-equivalent barrels per day.

Simultaneously, Russia and the US have ambitious plans for the future. Despite some slippage in supplies in the crisis year of 2020 after a surge in demand in the previous two years, both giants of the production and export of liquefied gas don’t intend to retreat from projects that will allow them to strengthen their place in the market.

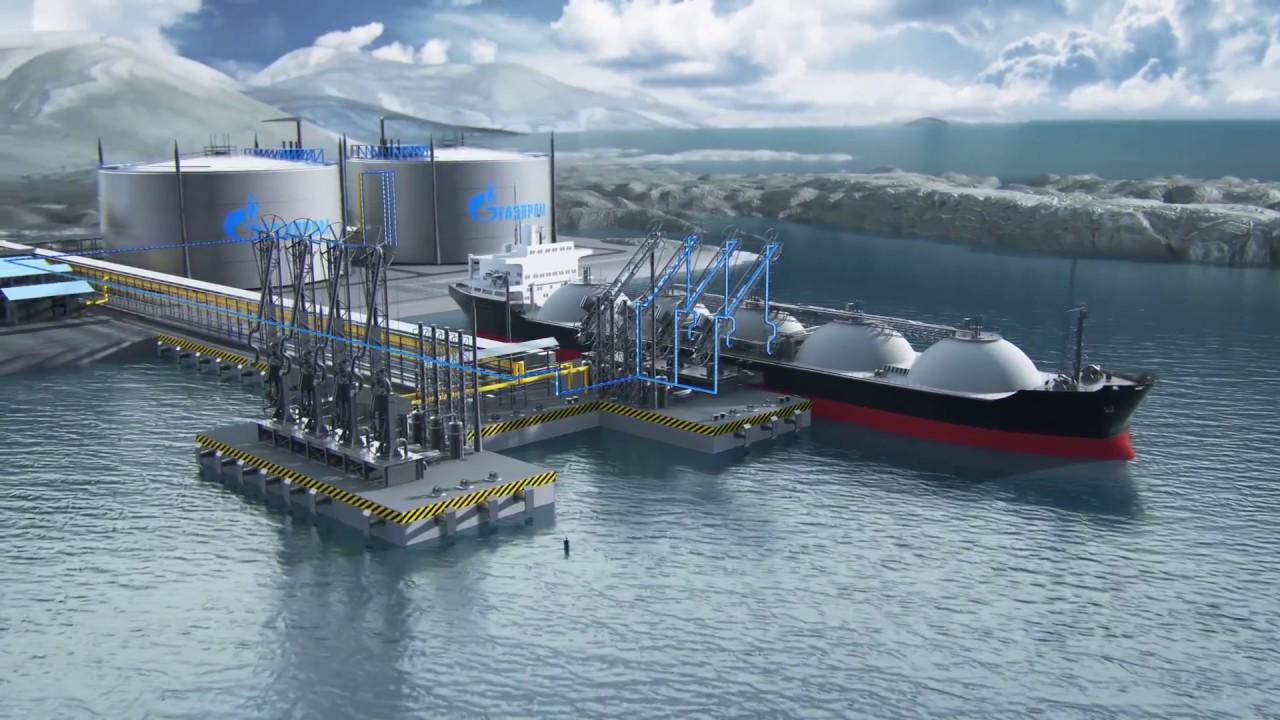

In particular, Russian analysts emphasize that even the pandemic and the fall in prices couldn’t reduce LNG export from Russia – it grew by 4.5 percent, to 30.2 million tons. The main buyers are Asian countries (Japan, South Korea, China), as well as Belgium and France. According to the announced plans, Russia is to build ten new plants to produce liquefied gas by 2035. Thus, a threefold increase in LNG production will be achieved.

Russian Energy Minister Alexander Novak stated that Russia could hold 25 percent of the world LNG market. “By 2025, the total capacity of our projects will be over 68 million tons per year. In the long term, Russia’s share in the global LNG market may reach a quarter of the global figure,” the minister added.

The fact is that Russia has the largest resource base in the world – about 20 percent of all proven reserves. Moreover, Russia is geographically close to both Europe and Asia. This allows LNG to be delivered to the consumer in the shortest possible time.

Meanwhile, the US is a rather tough competitor to Russia – according to a recent report from the Energy Information Administration of the country’s Department of Energy (EIA), the export of the US liquefied natural gas in 2022 will for the first time exceed the export of pipeline gas from the US. “EIA forecasts that US LNG exports will average 8.5 Bcf/d (billion cubic feet per day) in 2021. In 2022, EIA forecasts LNG exports will average 9.2 Bcf/d, surpassing the amount of natural gas exported via pipeline for the first time,” the report says.

The plans are quite realistic, considering that Beijing has given the green light to increasing the liquefied natural gas purchases from the US.

The Ministry of Finance of China published on February 18 a list of 696 names of US goods, the import of which from March 2 during the year won’t be subject to protective duties imposed in response to similar US measures. The list, along with numerous agricultural products, also includes energy carriers. According to experts from the German Economic Institute in Cologne, this will lead to the US becoming the leading supplier of energy resources to China in 2021, overtaking and significantly ousting Russia.

Good experience for Azerbaijan

As for Azerbaijan’s participation in the LNG market, the State Oil Company, through its SOCAR Trading division, has been actively participating in the market as a distributor since 2016. In a reasonably short time, the company succeeded in acquiring good experience in this area.

For example, it won the tenders of Pakistan LNG Limited (PLL) for LNG supply to Pakistan and has already been carrying out deliveries since August last year at prices favorable to both parties. Deputy Head of Public Relations and Event Management Department of SOCAR Ibrahim Ahmadov said that ‘liquefied natural gas is purchased from third parties and is part of our trade between third parties and buyers. This product isn’t exported from Azerbaijan due to the lack of our country’s direct sea access to the world ocean. Thus, offering LNG to Pakistan at a low price won’t affect Azerbaijan’s profit from selling its natural gas. At the same time, it is another step towards maintaining productive and warm economic relations with this partner and our friendly country.’

Recently, SOCAR Trading has offered to supply gasoline and liquefied natural gas on credit to Pakistan LNG Limited (PLL) and Pakistan State Oil (PSO) companies during the year under an intergovernmental agreement. The proposal was reportedly based on commercially acceptable terms for both parties.

SOCAR Trading also participates in the Ukrainian LNG market, and it holds an eighth place among the companies importing liquefied gas to this country.

Besides, Afghanistan uses Azerbaijan’s liquefied gas, although a little confusing history is connected with this country in this matter. Thus, last summer, information appeared in the press that the import of an Azerbaijani liquefied gas batch wasn’t allowed to this country, allegedly due to its low quality. However, later, the company representative said that Azerbaijani oil products enter Afghanistan through resellers and sometimes smugglers. Thus, the bulk of the liquefied gas in Azerbaijan is produced at the Heydar Aliyev Baku Oil Refinery and fully complies with quality standards. Ahmadov noted that high-ranking representatives of the Afghan government some time ago at meetings with the leadership of SOCAR expressed a desire to buy oil products directly from the company.

As for business within the country, the total number of SOCAR-branded filling stations in Azerbaijan with CNG equipment (compressed natural gas filling station) is 32, and the company plans to expand this network as the demand for this product will grow.

Undoubtedly, LNG will play a significant role in the path towards a lower carbon future. About 80 percent of the growth in global energy demand will be in renewables and gas. Therefore, deepening this direction in Azerbaijan’s fuel and energy balance is a task for the near future.

Expert Gulu Nuriyev